Hello Clients and Friends:

The 2018 Tax Season officially began January 28th. I am ready to serve your tax preparation needs, so you may start sending your documents over at any time. Please take a moment to read the details below.

Getting Your Documents To Me, Drop-Offs and Appointments

CURRENT CLIENTS: In order to meet the needs of clients who cannot make it to South Hayward, I’m making a few changes to our meeting location. Refer to the email I sent you for for details.

Remember. The Drop-Off / Pick-Up Days are for drop-offs of documents and quick conversations. – PLEASE CONFIRM 48 hours prior to meeting date. If no one confirms for a particular day, I will cancel the session.

NEW CLIENTS: I am currently accepting VIRTUAL new clients for personal tax returns and tax consultations. I am also accepting new small business clients in a limited geographical area for tax returns, tax consultations and bookkeeping consultations & training only. No actual hands-on bookkeeping.

Other options for getting your tax paperwork to me without having a face-to-face meeting include:

- fax to 510-868-2928 or email

- mail to: 1852 W. 11th Street #586, Tracy CA 95376 (Mail COPIES only please. BLACK OUT your social security number)

- Upload to a secure Cloud folder on Box.com. If you’d like to give this a try let me know I will send you an online invitation. If you’ve used this option in the past, you can still log-in using the same user name and password as before.

- Limited Face-to-face tax preparation and consultation meetings take place in Tracy, CA or virtually via Google Hangout or Zoom.

- Appointment hours are: Fridays (except 3/1) after 12 noon AND Saturdays (except 3/2 or 4/6) 10am to 2pm

If you’re sending your documents to me over the internet, for the safety of your data, I recommend you upload your documents to my secure Box.net cloud system. If you’d like to give it a try, just let me know and I will send you an invitation to collaborate via Box.

If you’re not comfortable uploading document, and simply want to email them to me, please BLACK OUT all social security numbers on your documents.

The cut-off date for on-time filing

If you want your taxes filed by the April 15th deadline, I must have all your documents by Tuesday, April 2nd and payment for my services by Friday April 12th.

DOCUMENTS TO SEND

- Completed Tax Prep Questionnaire (see your email or ask me for it)

- All Form W-2, 1099s, 1098s, and other income files

- All income and expense statements for your small business or gig-services performed (UBER, Lyft, Door Dash…)

If you’re a Small business owner (including landlords) – Form 1099-misc and form 1096

- If you paid any individual or non-incorporated business more than $600 during 2018, Federal law requires you to report those payments and to give the recipient a form 1099-misc showing their income by January 31, 2019.

IF you plan to take the EDUCATION CREDIT for you or your dependent’s HIGHER EDUCATION expenses please make sure you send

- Form 1098-T (Tuition Statement) received from the educational institution

- A copy of the statement of account showing all the expenses charged and payments made to the school.

Proof of Medical Insurance for every month in 2018 for you and each of your dependents. This should be the last year you’ll be required to send this form.

- Form 1095-A – for individuals who purchase insurance coverage through the exchange.

- Form 1095-B – if you have an individual policy purchased directly from an insurance company or that is provided through your employer.

- Form 1095-C – if you have an insurance policy purchased through your employer, and the employers is considered to be an Applicable Large Employer.

Proof of Dependency

If you’re planning to claim any of the following individuals as your 2018 dependent, please let me know so I can send you the appropriate form to complete. The form is needed to determine whether or not you have the legal right to claim the individual as your dependent. This generally pertains to you claiming:

- An individual who is 18 and over and no longer attending high school

- An individual who is NOT your biological or legally adopted son or daughter

- An individual who is under the age of 18 and earned income of $6300+ OR who $1050+ in interest/dividend/stock income

Feel free to contact me with any questions you may have.

IF you’ve chosen to work with a different tax preparer this year or plan attempt doing your own taxes, please shoot me a quick email letting me know so I can check you off my list this year.

IF you’re in need of a Tax Consultation I’m available for phone, Google hang-out or Zoom appointments at the rate of $30 for 20 minutes. Fees must be pre-paid.

Thank you for your continued business. Please know that it’s been my pleasure serving you over the years.

God’s blessing to you!

Michelle Walker-Wade, Serving you since 2003

RECAP OF DATES TO KNOW

- January 28th – Tax Season began

- Mon – 2/4 early evening appointments by special arrangement

- Fri/Sat – 2/8 & 2/9 – Already booked

- Wed – 2/13 – Drop-off Night

- Fri/Sat – 2/15 & 2/16 – Appointments available

- Fri/Sat – 2/22 & 2/23 – Appointments available

- Fri – 3/1 – Pick-up Day for my Senior Clients

- Sat – 3/2 – No face-to-face appointments

- Thu -3/7 – Drop-off Night

- Fri/Sat – 3/8 & 3/9 – Appointments available

- Fri – 3/15 – Appointments available (Sat 3/16 is booked)

- Fri/Sat – 3/22 & 3/23 – Appointments available

- Fri/Sat – 3/29 & 3/30 – Appointments available

- Tues – 4/2 – Last day to provide documents for an on-time tax filing

- Sat – 4/6 – No face-to-face appointments

- Fri – 4/12 – Last day to pay for a guaranteed on-time filing

- Sat – 4/13 – All E-files will be completed

- Mon – 4/15 – Official Tax filing deadline for PERSONAL Taxes

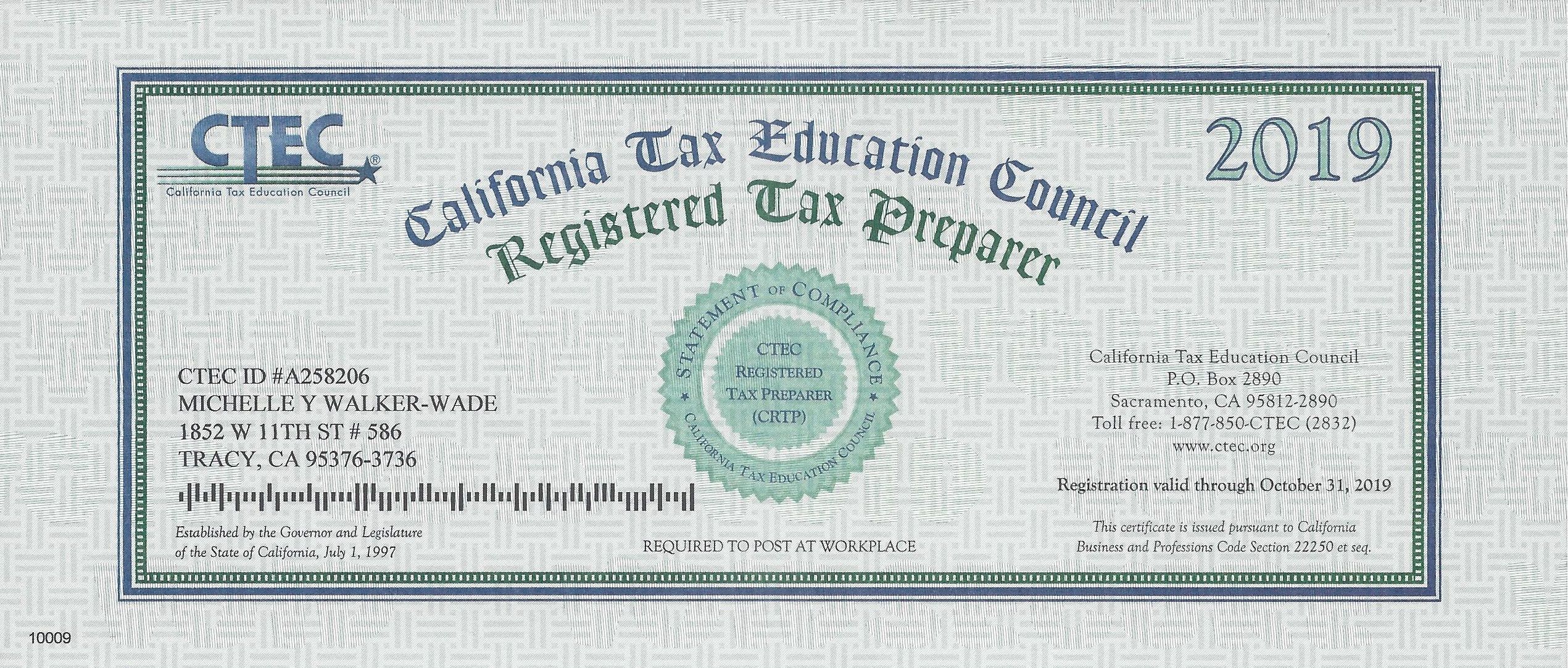

State and Federal Law requires me to share the following information with clients

- CTEC ID •A258206 for 2013-2019 •A131004 for 2003-2013

- Verify my credentials at: https://ctec.org/verify

- Surety Bond: State Farm 97-Q5-8473-8

- Online: mywalktax.wordpress.com

- Email: ask

- Text: ask

- VOICE MESSAGE: ask

- Mail: 1852 W. 11th Street #586, Tracy CA 95376

- Tracy Appointments: Location by arrangement