Before I start-in on the answer to this question, please understand this article only pertains to individuals who use their personal vehicle for self-employed, freelance, or 1099 contract work. Any work you do for an employer from whom you receive a form w-2 does not apply; even if you are the owner. If you (as the owner) reports your income to the IRS using a Form w-2, this does not pertain to you.

personal vehicle for self-employed, freelance, or 1099 contract work. Any work you do for an employer from whom you receive a form w-2 does not apply; even if you are the owner. If you (as the owner) reports your income to the IRS using a Form w-2, this does not pertain to you.

OK… now that I’ve established who my audience is, I want to discuss the massive documentation necessary to take the automobile expense deduction on your Schedule C – the MILEAGE LOG.

When it comes to this deduction, you have two choices:

- Use the standard mileage rate, which is set by the IRS and generally changes from year-to-year. Some years the IRS will provide one mileage rate for the first 6 months, and a different one for the next 6 months. We generally do not know what this rate will be until the end of the calendar year.

–OR–

- Use actual expenses. This includes lease payments, repairs, maintenance, gas, insurance and registration. You MUST have maintained all receipts in order to use actual expenses; estimates will not due.

Once you’ve chosen an automobile expense deduction method, you generally have to stick with it forever. You may, however, start with actual expenses, then switch to standard mileage; BUT once you make this switch, you cannot go back to actual expenses in subsequent years. Basically, once you go standard mileage, you’re standard mileage for the life of the vehicle.

Understand this CLEARLY – the law requires you to maintain a strict mileage log for both methods. There is no getting around the mileage log. The purpose of the mileage log is to substantiate the percentage of miles driven for…

- business VS. personal VS. work

Here, work and business are not the same thing. “Work” is commuting and driving for your w-2 job (with one exception, which I will not explain now). “Business” is the miles driven for the purpose of self-employed, freelance, or 1099 contract work.

So, the question of the hour is this: Does the IRS ‘Really’ Expect Detailed Driving Records for My Automobile Expense Deduction??? The answer is YES; No debates, no arguments.

You don’t have to take my word for it… Here are some direct quotes from IRS Publication 463 on Car Expenses:

Business and personal use. If you use your car for both business and personal purposes, you must divide your expenses between business and personal use. You can divide your expense based on the miles driven for each purpose.

- Example. You are a sales representative for a clothing firm and drive your car 20,000 miles during the year: 12,000 miles for business and 8,000 miles for personal use. You can claim only 60% (12,000 ÷ 20,000) of the cost of operating your car as a business expense. (PAGE 17, COLUMN 1)

What Are Adequate Records?

You should keep the proof you need in an account book, diary, log, statement of expense, trip sheets, or similar record. You should also keep documentary evidence that, together with your record, will support each element of an expense. (PAGE 25, COLUMN 3)

If you claim any deduction for the business use of a car, you must answer certain questions and provide information about the use of the car. The information relates to the following items.

- Date placed in service.

- Mileage (total, business, commuting, and other personal mileage).

- Percentage of business use.

- After-work use.

- Use of other vehicles.

- Whether you have evidence to support the deduction.

- Whether or not the evidence is written

(PAGE 34, COLUMN 2-3) – All of this information is recorded on the automobile expense worksheet used to prepare your tax return. You should give this do your tax preparer each year.

Car expenses. You can account for several uses of your car that can be considered part of a single use, such as a round trip or uninterrupted business use, with a single record. Minimal personal use, such as a stop for lunch on the way between two business stops, is not an interruption of business use. (PAGE 26, COLUMN 3)

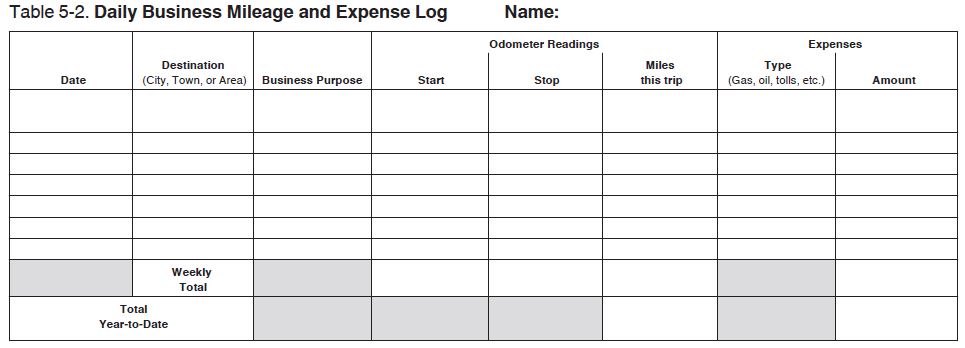

Here’s the recordkeeping format the IRS recommends, although other formats will work as long as you have the required details:

Lastly, I want to share this case with you. It was filed in 2013 and pertained to the petitioner’s 2008 tax return (yes 5 years later). One of the issues raised was whether the petitioner may have deducted car and truck expenses. I’m sharing excerpts here; but you can read the entire ruling at: http://ustaxcourt.gov/InOpHistoric/striefel.TCM.WPD.pdf

JEFFREY SCOT STRIEFEL, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent

- The petitioner reported $92,712 of car and truck expenses on his 2008 income tax

- Sec. 280F(d)(4)(A)(i) and (ii) says the Petitioner’s car and truck expenses, are subject to the strict substantiation rules.

- Petitioner testified at trial that he maintained a “drive log” in 2008, but he failed to introduce it into evidence, presumably because he destroyed it.

- Petitioner also attempts to establish the amount of mileage he drove while working for Steen Engineering. Petitioner testified that he drove approximately [*11] 90,000 miles in six months.

- He attempts to reconstruct his mileage log using three documents prepared by Steen Engineering

- The Steen Engineering documents fail to meet the requirements of strict substantiation

- In order to determine the precise number of miles petitioner drove, he would need to provide, at a minimum, documentation showing his route between project sites.

- He failed to provide more than general information regarding the start and end locations for each travel leg.

- Accordingly, petitioner is not entitled to deduct any car and truck expenses for tax year 2008.

He was ordered to repay the refund amount attributed to mileage along with a penalty and interest back-dated to April 15, 2008.

Maybe you’re thinking you will never have this extensive amount of mileage so you don’t need to worry about it. I’d recommend you take a look at your Schedule C, Line 9. Imagine finding out 5 years after you’ve filed the current tax return that the amount is being reversed and you’ll need to pay back the refunded amount attributed to that line item, plus penalty, plus 5% accrued interest for every month since April 2008.

— Thinking Time —-

It’s worth it to take time out and record your mileage. This issue is particularly of interest due to all the self-employed rideshare businesses popping up like UBER, Lyft and other personal transportation services. Mobile pet groomers, house cleaning services, handy-man services, independent sales professionals and every other business that involves an extensive amount of driving should be aware as well.

At the very least, record this information EVERYDAY (whether you incur business miles that day or not):

- Starting odometer reading

- Ending odometer reading

- Number of miles driven for business (that day)

- Number of miles driven for other purposes (that day)

Record this information anywhere you know you can keep it for 7 years and will be able to present it to the ‘powers that be’ upon request. There are also smartphone apps that help with this type of record keeping. If you decide to go with an app, make sure it’s one for which you can print-off reports. In this case, I suggest not waiting until year-end to print mileage reports. Go ahead and do it no less than monthly.

I hope this helps you!

2 thoughts on “Does the IRS ‘Really’ Expect Detailed Driving Records for My Automobile Expense Deduction???”