One of my Tax Pros collogues recently said: “I’ve been preparing taxes for years, I’m an Enrolled Agent, and I have really tried to figure this out, but I’m still confused.

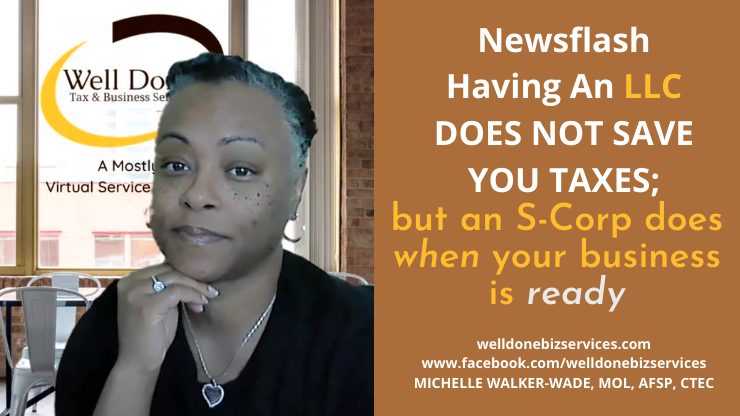

HOW DOES BEING AN S-CORP SAVE YOU MONEY???

Well… here’s 8 minute video of Mark Kohler, CPA explaining how it works. I’ve also included a link to one of Mark’s blogs that gives you a high-level look at the “Kohler Payroll Matrix” where you’ll see where the LLCs net revenues should be when it’s most beneficial to make an S-Corp election. You can convert from an LLC to an S-Corp within the calendar year and it still count for the year. However, you cannot do the same conversion from an a Sole Prop to an S-Corp. You’d have to create a brand new entity.

In short, when the business income is high enough – which 40,000 net or higher, an S-Corp could save the owner thousands in self-employment taxes.

Watch the video above, and take a look at Mark’s blog, Dial in Your S-Corp Strategy BEFORE Year-End for an overview of how it works. As a tax & business management pro, I look forward to the day I can help one of my clients transition into an S-Corp!

“Bottom line, the S-Corp strategy works when it is used properly and is not abused. If you are making more than $40,000 (net) in your business, could use the asset protection and you are ready to build corporate credit or better legitimize your business, an S-Corp could be a perfect fit for you!” – Mark Kohler

https://markjkohler.com/dial-in-your-s-corp-strategy-before-year-end/