You only do it once a year, so it can be difficult to remember what documents are needed. If I’m your tax preparer, start with this one 2016 Client Tax Questionnaire Client Tax Questionnaire, and provide a copy of your social security card and your state issued identification.

You only do it once a year, so it can be difficult to remember what documents are needed. If I’m your tax preparer, start with this one 2016 Client Tax Questionnaire Client Tax Questionnaire, and provide a copy of your social security card and your state issued identification.

Next, do the following:

FIRST – — Verify the social security numbers and birthdates of every person on your tax return. If you’re adding a new person, please include a copy of their social security card and their birthdate.

THEN get these documents…

Any and all of the following income statements:

- W-2 — Wages from employment

- W-2G — Winnings from gambling & raffles

- 1099-Int — Interest

- 1099-Div — Dividends

- 1099-R — Distributions from Retirement Plans

- 1099-G — Monies received from the government (most common is your last year’s State refund and/or Unemployment insurance payments

- 1099-B — Sale of stock

- 1099-Misc — Miscellaneous Income (most common is payments for work completed as an Independent Contractor, Insurance and/or legal settlements, and royalties)

- SSA-1099 – Social Security payments

- 1099-C — Debts Cancelled

If you or one of your dependents took post-secondary courses

- 1099-T — Tuition statement showing monies paid to a school

- Your detailed statement of account from the school (you can get this by logging in to your student account online.

- Copies for receipts for books and materials purchased

- If living away from home, details about room & board expenses.

- Transportation expenses

- 1098-E — Student loan interest statement

Common documents for itemized deductions

- Form 1098 – Mortgage interest statement

- Your Property Tax bill

- Detailed Records of charitable contributions given

- Medical insurance premiums paid IF you paid them with after-tax dollars (many employer plans use pre-tax dollars; we can figure this out using one of your payroll check stubs).

- A record of other medical expenses paid out of pocket (not including over-the-counter drugs)

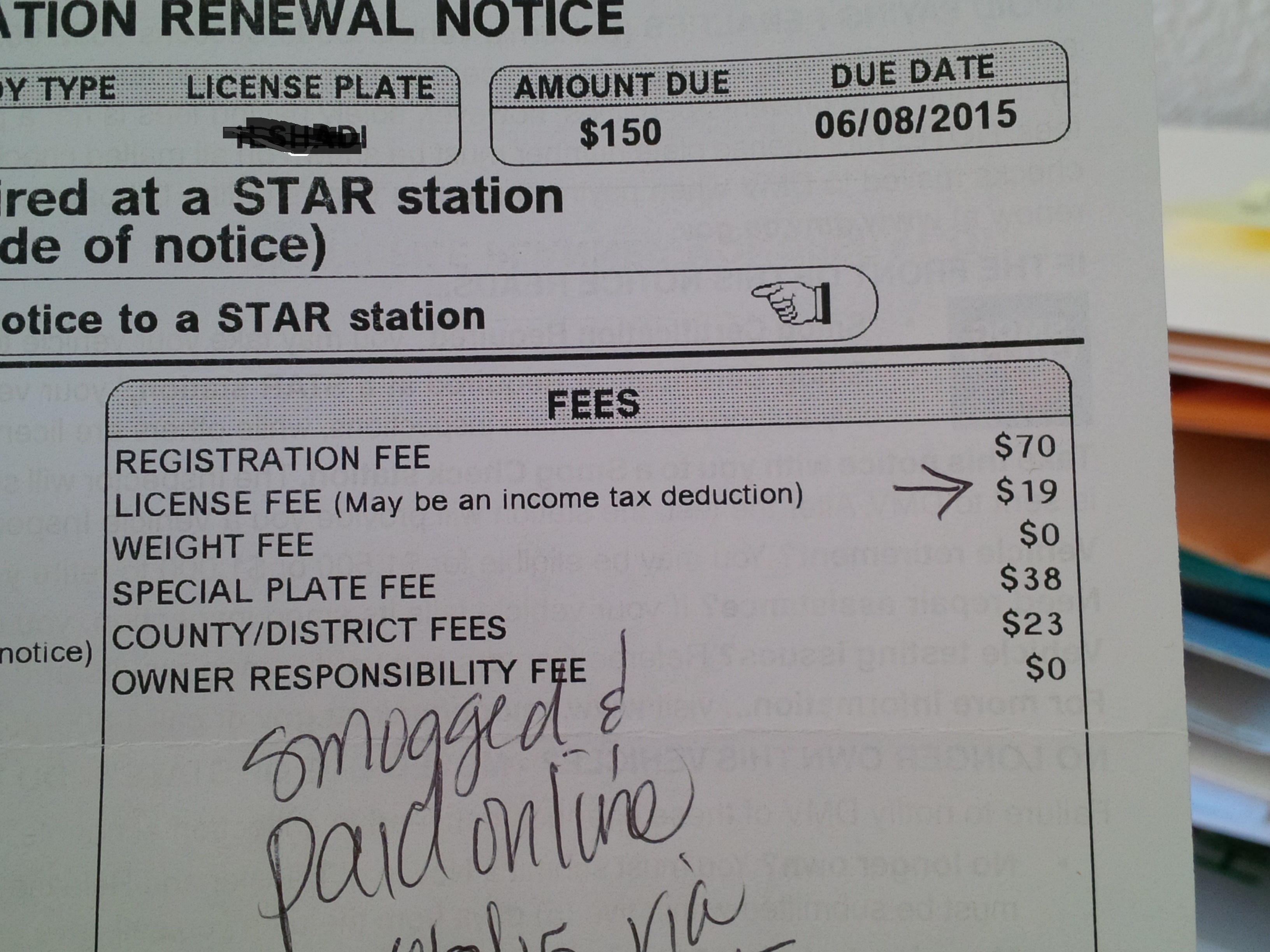

- Your DMV registration bill (not you vehicle registration) that shows the break-down of fees, as shown below.

- Union dues paid

Other items

- 1095-A, B or C — Proof of health insurance for all 12 months of the year

- Day care expenses paid for your children (you must include your providers name, business name, tax ID number, address(es) and phone number.

- If you rent, your Landlord’s information (name, address where he/she lives, phone number) and the dates which you lived in that property for the year.

- Your bank account information (account type, bank name, routing number, and account number). This is if you’d like your tax refund directly deposited or your tax payment electronically debited from your account.

What else? If you have a small business or if you performed work as a Independent Contractor (1099 work):

CLICK HERE to learn how to categorize your business expenses

CLICK HERE to learn how the IRS expects you to manages your business income and expenses

CLICK HERE to learn what’s required to write of ANY vehicle expenses (including gas — you cannot just use a gas receipt)

CLICK HERE to learn what the IRS requires you to do if you paid an individual or small business over $600 during the tax year

CLICK HERE to learn what the IRS requires you to do about business barters.

If you’re a New Client, please provide:

- A copy of the social security card of every person listed on your tax return

- A copy of last year’s tax return