Once you’ve chosen a school, your qualified education expenses (registration, tuition, books & supplies, and in some cases, activity fees) are generally tax advantageous unless those expenses were offset by a scholarship or grant of some kind. The two most applicable education credit options are the American Opportunity Credit and the Lifetime Learning Credit. There is also the possibility of a tax deduction, called the Tuition & Fees Deduction. In most cases, tax credits put more dollars back in your pocket than do tax deductions.

Once you’ve chosen a school, your qualified education expenses (registration, tuition, books & supplies, and in some cases, activity fees) are generally tax advantageous unless those expenses were offset by a scholarship or grant of some kind. The two most applicable education credit options are the American Opportunity Credit and the Lifetime Learning Credit. There is also the possibility of a tax deduction, called the Tuition & Fees Deduction. In most cases, tax credits put more dollars back in your pocket than do tax deductions.

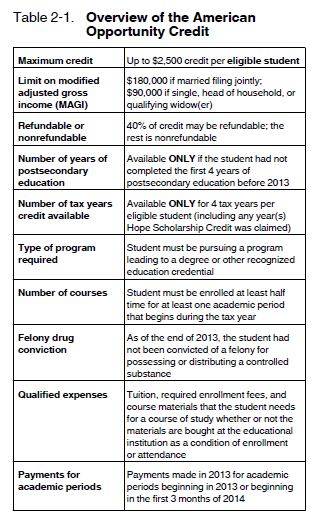

If you meet the qualifications, the American Opportunity Credit is the most advantageous. Let’s take a look at them both.

Qualified education expenses under the American Opportunity Credit are:

• Tuition and student-activity fees are included only if the fees are paid to the institution as a condition of enrollment and attendance.

• Expenses for books, supplies, and equipment needed for a course of study whether they are purchased from the educational institution or not.

- You CAN deduct a computer used for school under the American Opportunity Credit (but not under the Lifetime Learning credit)

- This credit is applicable per eligible student. So, if more than one person on your tax return is eligible for this credit, you can take it for multiple students.

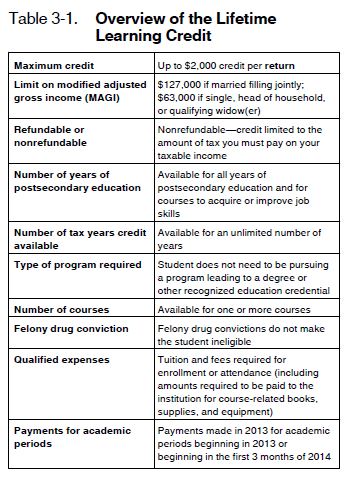

Qualified education expenses under the Lifetime Learning Credit are:

• Tuition, student-activity fees, and expenses for course-related books, supplies, and equipment only if the fees and expenses must be paid to the institution as a condition of enrollment or attendance.

- You CANNOT deduct a computer used for school under the Lifetime Learning credit because eligible expenses must be paid directly to the educational institution.

- This credit is per return. So, no matter how many students are eligible, you only get one shot at this credit.

What expenses are NOT qualified education expenses (even if they were paid to the institution as a condition of enrollment or attendance)?

- Insurance

- Medical expenses(including student health fees)

- Room and board or any other living expenses

- Transportation

- Expenses for sports, games or hobbies

- Any non-credit course unless it is taken by the student to acquire or improve job skills.

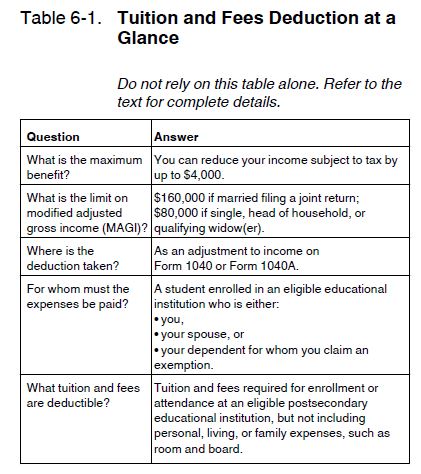

Finally, you may want to consider the Tuition & Fees Deduction. The deduction is limited to (just as it says) tuition and certain expenses required for enrollment, including: student-activity fees and expenses for course-related books, supplies, and equipment. These fees must be paid to the institution.

Some things to note:

- College application fees and SAT/ACT and other testing fees can not be applied any tax advantage.

- If you use Married Filing Separate as your tax status, you automatically disqualify from all of these (and many other) tax advantages.

- If a tax credit is non-refundable, you can only receive a refund up to the amount of income taxes you’re already paid in to the system (for example via your payroll deductions) that have not already been refunded from other deductions and credits on the tax return.

- You can only use ONE educational tax strategy per student. Choose the best one for your circumstance. Most tax software programs will help you choose.

- There are no tax advantages for K-12 education expenses. These only apply to post-secondary expenses such as community college, vocational college, and universities.

The possibilities for education-related tax advantages are many. Take a look at this IRS chart to see if any other options may apply to you.

- 2013 Education Benefits Overview (2014 has not yet been published)

Please feel free to comment or ask questions about the information in this article. The IRS has a 94-page publication dedicated to Tax Benefits for Education, so there’s always more we could say on this subject.

Happy Tax Time!