With all of the tax law changes Congress made the American Taxpayer Relief Act (ATRA), the Internal Revenue Service announced the 2013 filing season will begin January 30th. The IRS hoped to open by January 22nd, but there is just too much work needed to update the tax code and reprogram the systems.

the tax law changes Congress made the American Taxpayer Relief Act (ATRA), the Internal Revenue Service announced the 2013 filing season will begin January 30th. The IRS hoped to open by January 22nd, but there is just too much work needed to update the tax code and reprogram the systems.

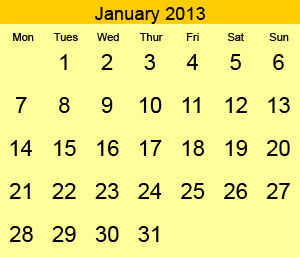

Most filers will be able to file electronically or by paper starting this date (Jan 30th). However, if you’re claiming residential energy credits, are required to depreciation of property or are claiming general business credits, you’ll have to wait until the end of February/beginning of March to file your taxes this year.

My apologies to all of my early filers… You’ll have to wait until January 30th this year.

God Bless!